Like many, you may plan financial stability around your monthly paycheck. Losing a job can create a ripple effect, turning once-manageable expenses into overwhelming burdens. Among these, property taxes often become the tipping point for homeowners facing financial stress.

Why Job Loss and Property Taxes Are a Difficult Combination

A sudden job loss can quickly drain savings, leaving little room to cover significant expenses like property taxes. These twice-yearly payments can wipe out what’s left of your reserves, especially if you’re also juggling other financial responsibilities.

The consequences of unpaid property taxes can be severe. Most local governments impose penalties and interest on late payments, which can compound quickly and make the debt unmanageable.

In worst-case scenarios, the government can place tax liens on your home, or you could face foreclosure. This financial pressure often forces homeowners to seek immediate solutions, such as selling their property to avoid falling further into debt.

What You Should Know About Property Taxes and Property Liens

Property taxes are calculated based on the assessed value of your home and the local tax rate. These funds support essential services like schools, public safety, and infrastructure. However, they can be a significant financial burden, especially during periods of economic instability.

Many homeowners don’t realize that property taxes continue to accrue even if you’re struggling financially. If unpaid, these taxes can result in a tax lien—a legal claim against your property by the government. You must settle this lien before selling your home, so working with a real estate investor experienced in resolving liens can be a wise choice.

Did You Know There Are Tax Lien Buyers?

If you fail to pay your property taxes, your local government may sell your tax debt to a tax lien buyer. These buyers pay off your overdue taxes in exchange for the right to collect what you owe, often with added interest. If you can’t repay the lien within a specific timeframe, the lien buyer could foreclose on your property.

Selling your home before this happens is crucial to protecting your financial future. Real estate investors who understand tax lien processes can help you navigate this challenging situation, ensuring a smooth sale and avoiding foreclosure.

If you’re facing an upcoming tax bill but don’t have the means to pay or need cash fast, selling your home to a real estate investor may be a practical solution. Here’s how cash house buyers can help ease the burden and provide quick relief.

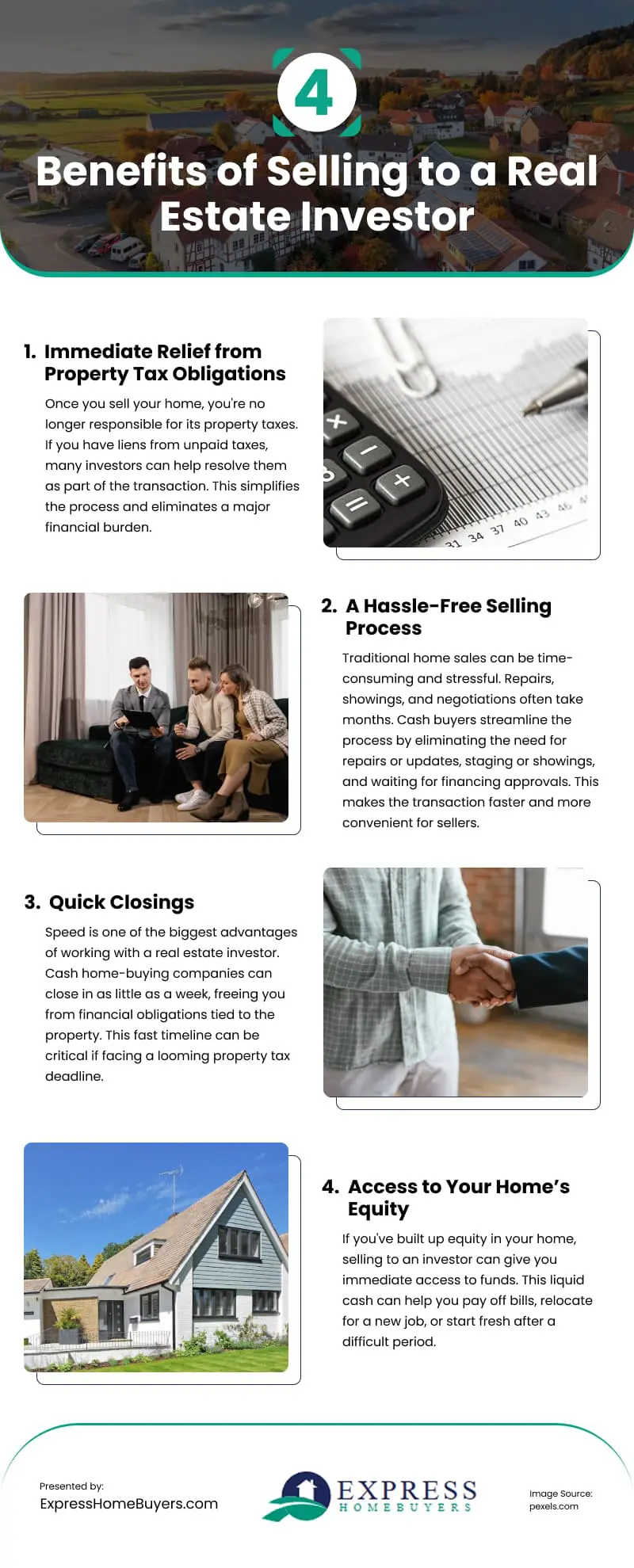

The Top 4 Benefits of Selling to a Real Estate Investor

Selling your home to a real estate investor is a practical solution for financial difficulties. Here’s how this option can help:

1. Immediate Relief from Property Tax Obligations

Once you sell your home, you’re no longer responsible for its property taxes. If you have liens from unpaid taxes, many investors can help resolve them as part of the transaction. This simplifies the process and eliminates a major financial burden.

Companies that buy homes for cash specialize in these situations, offering a lifeline to homeowners feeling the pinch of an impending tax deadline.

2. A Hassle-Free Selling Process

Traditional home sales can be time-consuming and stressful. Repairs, showings, and negotiations often take months. Cash buyers streamline the process:

- No repairs or updates are needed.

- No staging or showings.

- No waiting for financing approvals.

This makes selling to an investor a stress-free, fast option during an already overwhelming time.

3. Quick Closings

Speed is one of the biggest advantages of working with a real estate investor. Cash home-buying companies can close in as little as a week, freeing you from financial obligations tied to the property. This fast timeline can be critical if facing a looming property tax deadline.

4. Access to Your Home’s Equity

If you’ve built up equity in your home, selling to an investor can give you immediate access to funds. This liquid cash can help you:

- Pay off bills

- Relocate for a new job

- Start fresh after a difficult period

How to Get Started with a Cash Sale

The process is simple and fast. First, schedule an assessment with a real estate investor. They will assess your property and make you an offer. Next, review the offer. Because investors work with cash, there are no delays waiting for loan approvals.

Finally, you can close quickly. Once you accept the offer, the deal can be finalized in days, not weeks or months. You can even choose the day you close or move out.

Take Control of Your Financial Future

Job loss is never easy, but understanding your options can make all the difference. Selling your home for cash offers a fast, practical solution to alleviate the burden of looming property taxes. It provides immediate financial relief and frees you from the stress of homeownership, giving you the flexibility to move forward.

Whether you’re downsizing, relocating for new opportunities, or simply looking for a fresh start, a cash sale can help you confidently take the next step. By acting quickly and partnering with an experienced real estate investor, you can regain control of your financial future and leave the challenges of unpaid property taxes behind.

Video

Infographic

If you need to pay a tax bill or need cash quickly, selling your home to a real estate investor could be a practical solution. Check out this infographic to learn more about how selling your home to a real estate investor can be beneficial.