“We Buy Houses – A scam?”

Video Series – Part 5

Enter your address and get a quote on your house within 24 hours!

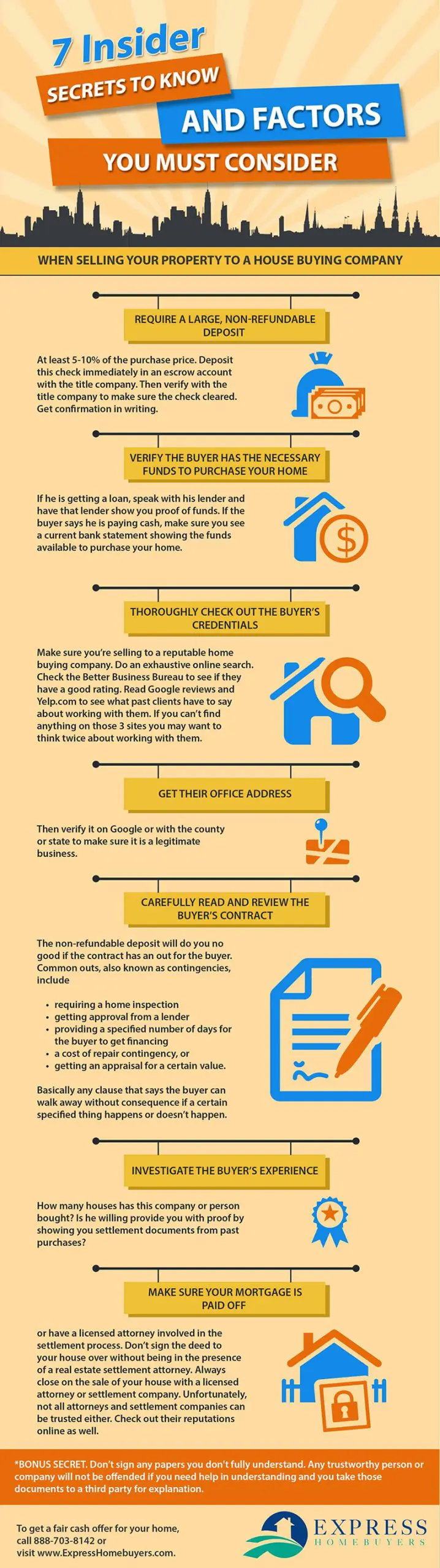

How do you avoid these nightmare situations? Just like in any industry, there are good guys and there are not-so-good guys. Armed with the right information, you’ll be able to tell them apart and make the best decision. Here are the 7 insider secrets to know and factors you must consider when you’re selling your property to a house buying company. If you take the time to follow these steps, it’s highly unlikely you’ll become a victim of any “we buy houses” scams.

Key facts pertaining to this particular We Buy Houses Scam according to fsbo.com blog:

- Buyers are usually from out of the country

- The average amount they are currently sending for down payment is $38,000

- The average amount they are asking for you to return is $8000

The second secret is to verify the buyer has the necessary funds to purchase your home. If he is getting a loan, speak with his lender and have that lender show you proof of funds. If the buyer says he is paying cash, make sure you see a current bank statement that shows the funds available to purchase your home.

Number three – thoroughly check out the buyer’s credentials. I don’t need to tell you that your home is most likely your single biggest asset. You want to make sure you’re selling to a reputable home buying company. Do an exhaustive online search. Check the Better Business bureau to see if they have a good rating. Read Google reviews and yelp.com to see what past clients have to say about working with them. If you can’t find anything about them on those 3 sites you may want to think twice about working with them.

The fourth thing is to get their office address. You may want to verify it on Google or with the county or state to make sure it is a legitimate business.

The fifth secret is to carefully read and review the buyer’s contract. The non-refundable deposit will do you no good if the contract has an out for the buyer. Common outs, also known as contingencies, include

- requiring a home inspection

- getting approval from a lender

- providing a specified number of days for the buyer to get financing

- a cost of repair contingency, or

- getting an appraisal for a certain value.

Basically any clause that says the buyer can walk away without consequence if a certain specified thing happens or doesn’t happen.

Number 6 – investigate the buyer’s experience. How many houses has this company or person bought? Is he willing provide you with proof by showing you settlement documents from past purchases?

The seventh secret is – make sure your mortgage is paid off or have a licensed attorney involved in the settlement process. Don’t sign the deed to your house over without being in the presence of a real estate settlement attorney. You should always close on the sale of your house with a licensed attorney or settlement company. Unfortunately, not all attorneys and settlement companies can be trusted either. Check out their reputations online as well.

And before I sign off today, here’s the bonus secret. DON’T SIGN any papers you don’t fully understand. Any trustworthy person or company will not be offended if you need help in understanding and you take those documents to a third party for explanation.

So there you have it, the “we buy houses” scams to lookout for and the 7 secrets you can use to protect yourself from them.